The Future of Insurance in DeFi

When most people hear ‘insurance’, their eyes glaze over. It’s one of those things we pay for, hope we never need, and kind of resent when we do. But in crypto, especially DeFi, insurance is starting to look less like boring paperwork and more like a lifeline. It might just change the way we think about financial safety entirely.

Why DeFi Feels Risky and Why We Need Insurance?

DeFi (Decentralized Finance) is booming. Lending platforms, yield farms, staking protocols, automated market makers… the list goes on. It’s exciting. But it’s risky. One buggy smart contract, one exploit, and – boom – your funds vanish.

In 2025, billions in crypto are locked in protocols every day. The upside? Huge. The downside? Heart-stopping. This is exactly why insurance is becoming crucial. Without some sort of safety net, many investors won’t feel comfortable diving in.

Decentralized Insurance: What’s the Deal?

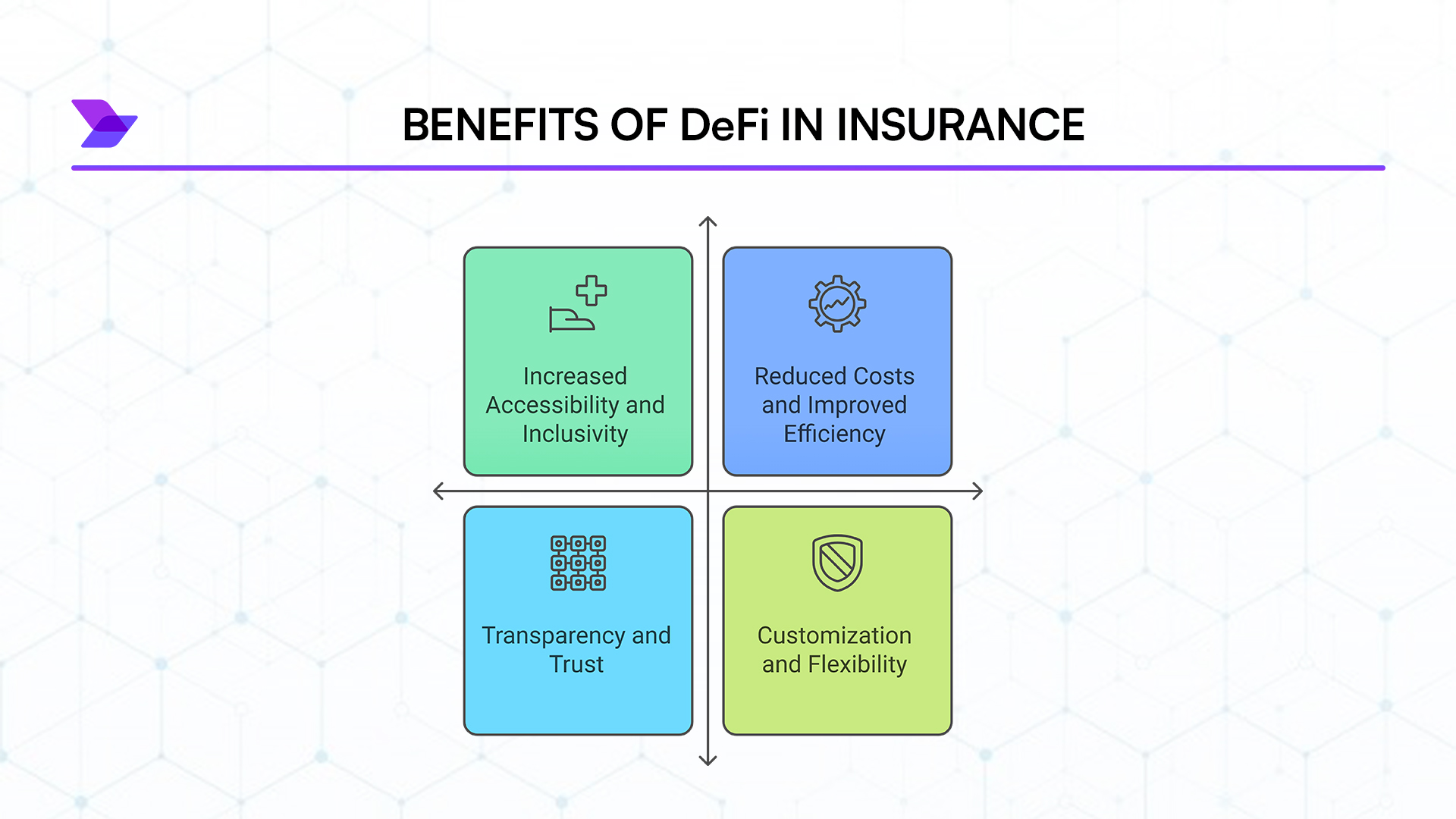

Now, don’t think of this like your age-old insurance. We’re talking decentralized insurance. No middlemen, no giant corporations deciding your fate. Instead, it’s smart contracts, liquidity pools, and risk-sharing among users. Peer-to-peer protection built right into the blockchain.

Here’s a simple analogy: imagine a group of strangers pooling money together. If a protocol gets hacked, the pool covers the loss. Everyone chips in a little, so no single person gets crushed. And it’s transparent – you can see the pool, the claims, even vote on protocol changes. Compare that to traditional insurance: fine print, delayed claims, and a lot of “we’ll see.”

The Hurdles: Pricing, Coverage, and Liquidity

Let’s not sugarcoat it. DeFi insurance isn’t perfect.

Pricing risk is tricky. In traditional finance, actuaries crunch mountains of historical data. In DeFi? Protocols launch weekly. Hacks happen. Exploits pop up like weeds. How do you price insurance when the rules change daily?

Coverage limits are another challenge. Most DeFi insurance only protects against smart contract failure or hacks. Rug pulls, phishing attacks, user mistakes – those aren’t covered. So carefulness still matters.

Liquidity issues can be scary too. Insurance pools need cash to pay claims. If too many claims hit at once – say during a big hack – the pool could run dry. Some protocols are experimenting with reinsurance or layered coverage, like “insurance for insurance.” Wild, right?

Innovations That Might Blow Your Mind

Despite the hurdles, innovation is happening fast. Platforms like Nexus Mutual and InsurAce prove there’s demand. Users are willing to pay for peace of mind – and who can blame them? Losing $10k in a flash isn’t fun.

Now, think bigger. DeFi insurance isn’t just about covering losses. Imagine insuring yield farming positions, staking rewards, even NFTs. Some protocols are testing parametric insurance, which pays out automatically when certain conditions are met – no forms, no waiting. It’s like sci-fi for finance.

Regulation, Trust, and the Human Element

Yes, regulation matters. DeFi is mostly unregulated now, but governments are catching up. Smart regulation could boost adoption by increasing trust. People who were hesitant might finally dip a toe in if they know there’s a safety net.

But here’s the kicker: DeFi insurance isn’t just tech. It’s social. It relies on community, voting, and shared risk. Trust and transparency matter as much as the smart contracts themselves. And honestly? That’s kind of beautiful.

The Future: Insurance as a Core Part of DeFi

So, what’s next? More innovation, better risk modeling, wider adoption. One day, buying DeFi insurance could be as routine as setting up a wallet or choosing a staking protocol. Policies might become tradable, collateralized, programmable.

At the end of the day, DeFi insurance is about confidence. Confidence to invest, to experiment, to push boundaries without constantly worrying about losing it all. Sure, bumps will happen – hacks, bugs, mistakes – but insurance could be the safety net that allows DeFi to grow safely.

Let’s be honest: it’s not just about preventing losses. It’s about peace of mind. Leveling the playing field. Giving everyday users a seat at the table. And in a crypto world that sometimes feels like the Wild West, that matters.

Closing Thoughts

Will DeFi insurance go mainstream? Probably. Maybe not overnight, maybe with hiccups. But the building blocks are there: community-driven risk, smart contracts, transparency, and a desire for new financial models.

The more insurance evolves, the more DeFi itself grows. Better protection → more adoption → more innovation → better protection. Round and round. Exciting times, really.

So keep an eye on DeFi insurance. It’s evolving fast, thrilling, messy, and full of possibilities. One day, it might be as normal as having car insurance. Today, it’s proof that even in a world built on code, people still care about trust.

English

English