Layer 2 DeFi Protocols Gaining Momentum

Let’s be honest: gas fees suck. If you’ve ever tried to do anything on Ethereum during a hype cycle, you probably felt like you were getting robbed just to swap some tokens or stake in a yield farm. And yeah, Ethereum’s security is top-notch, but man, it’s slow and expensive when things get busy.

That’s where Layer 2 (L2) solutions come in, and lately, they’ve been heating up, especially in DeFi.

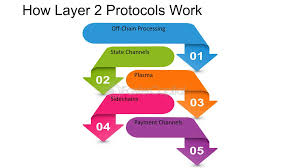

What’s the Deal with Layer 2?

Here’s a quick explainer. Layer 2s are like express lanes for blockchain. Instead of using Ethereum’s main network for every little transaction, L2s let you do stuff off-chain (or kind of next to the chain), then settle the results back on Ethereum. It’s like batching all your groceries at self-checkout and just scanning one big QR code at the end.

You still get the security benefits of Ethereum (mostly), but without the high gas fees and network congestion. Win-win.

Now, that’s been the pitch for a while, but in 2024 and now into 2025? We’re finally seeing it click. L2s aren’t just scaling solutions anymore. They’re becoming the home of DeFi innovation.

The DeFi Scene Is Moving Up

For a long time, DeFi lived on Ethereum Layer 1. Think back to the summer of 2020 Uniswap, Compound, Yearn… all the big players were doing their thing right on mainnet. But as more people piled in, the cracks started showing. Fees hit double or triple digits, and smaller users got priced out.

Now, fast forward to today. We’ve got ecosystems like Arbitrum, Optimism, Base, and even zkSync Era gaining serious traction. And DeFi protocols? They’re not just deploying there as an afterthought – they’re going all in.

Look at GMX. It launched directly on Arbitrum and became a top derivatives DEX, offering leveraged trading with low fees. Not a fork of something from mainnet. It’s original. And honestly? It’s working.

Why Is the Shift Happening Now?

Here’s the thing – it’s not just about gas fees anymore (though yeah, that’s still a huge part of it).

A few other reasons:

- Better UX: L2s are faster. Transactions settle quickly. Apps feel smoother. That’s what users want. No one wants to wait two minutes and pay $20 to swap a token anymore.

- Ecosystem support: Big protocols and wallets are finally treating L2s like first-class citizens. MetaMask, Coinbase Wallet, even major bridges – they’ve made it way easier to move between L1 and L2. It’s not perfect, but way better than it used to be.

- Incentives: Let’s not ignore the elephant in the room – airdrops. L2s and protocols launching on them are throwing out token incentives left and right. It’s like yield farming all over again, but with points and speculation. And hey, it’s working. People follow the money.

Protocols to Watch

Okay, you didn’t come here just for vibes. Let’s list the names. Here are a few L2 DeFi projects that are actually doing cool stuff right now:

1. GMX (Arbitrum & Avalanche)

We mentioned it earlier, but it deserves a second shout. It’s not a Uniswap clone. It’s a decentralized perpetual exchange with a unique liquidity model (GLP). Traders love it. Yield chasers love it. And it’s still innovating.

2. Velodrome (Optimism)

Kind of like the Curve of Optimism. Deep liquidity, vote-escrow tokenomics (ve-style), and a very active governance scene. If you’re yield farming on OP, chances are you’ve touched Velodrome.

3. Aerodrome (Base)

This one’s basically Velodrome’s cousin but on Coinbase’s Base chain. And yes, Base is growing fast. A ton of activity there lately, especially after the friend.tech boom and other social apps jumping on.

4. ZkSync Era protocols

Still early days, but keep an eye on zkLend, SyncSwap, and Mute. The zero-knowledge angle brings scalability and privacy, which might be a big deal if regulators start cracking down harder on open DeFi.

5. LayerZero-integrated apps

Okay, slightly cheating here – LayerZero isn’t an L2, it’s more like a messaging layer. But tons of protocols on L2s are using it to go cross-chain in new ways. It’s helping DeFi get less… siloed.

It’s Not All Sunshine and Rainbows

Let’s pump the brakes for a sec.

Layer 2s are great, but they’re not perfect. A few things to keep in mind:

- Security tradeoffs: Some rollups are still pretty centralized. Like, there’s an admin key or multisig that can pause or change stuff. That’s not exactly “trustless.”

- Liquidity fragmentation: With DeFi apps spread across Arbitrum, Optimism, Base, and others, it’s hard to know where the deepest liquidity is. Sometimes you gotta bridge and hope for the best.

- Onboarding friction: While it’s better than before, moving from L1 to L2 (or between L2s) is still kind of clunky. New users might bounce if it feels like too much work.

- Airdrop farming madness: Yeah, incentives are good, but when people are just farming for tokens and dumping after launch? That’s not sustainable. We’ve seen it before and will probably see it again.

The Momentum’s Real

Despite the flaws, it’s hard to ignore what’s happening. The center of gravity is shifting. Ethereum is still the foundation, but the real action? It’s happening on Layer 2.

We’re seeing new DeFi primitives, faster iterations, and actual user-friendly dApps. Stuff that feels less like beta software and more like the future of finance. Slowly, sure but it’s happening.

Here’s a thought: maybe in a year or two, launching on L1 will feel weird. Like why wouldn’t you deploy to an L2 first?

The Final Word

If you’re deep in DeFi, Layer 2s probably aren’t news to you. But if you’ve been sitting on the sidelines, waiting for the right time to dive in, this might be it.

Try a swap on Arbitrum. Stake something on Optimism. Explore what Base has to offer. It’s faster, cheaper, and frankly a lot more fun right now than mainnet.

And who knows? Maybe your airdrop bag will thank you later.

English

English