How to Track DeFi Portfolio Performance?

Let’s be honest. Keeping track of your DeFi portfolio can feel like herding cats. One day you’re yield farming on Arbitrum, the next you’re staking some obscure token on a DEX that barely loads on mobile. Meanwhile, prices are flying all over the place, gas fees keep changing, and you’re left wondering if you’re actually making money… or just vibing with volatility.

If that sounds familiar, you’re not alone.

DeFi’s cool. It’s powerful. But tracking performance? Not exactly plug-and-play. So, here’s a guide to help you stay on top of your DeFi bags without having to build a spreadsheet from scratch or lose sleep over impermanent loss.

Why Does Tracking Matter?

Quick story: I once farmed a promising token on a new protocol. It looked solid. APY was nuts (in a good way). Six weeks later, I checked again – turns out the token tanked 70%, and the gains I thought I had were… let’s just say they evaporated faster than ETH after a pump.

Lesson learned.

If you’re serious about DeFi, whether you’re farming, staking, LPing, or just hopping between chains like it’s a game of hopscotch, tracking your portfolio isn’t optional. It’s how you know what’s working, what’s bleeding, and where to pivot.

The Challenges of Tracking a DeFi Portfolio

Traditional portfolio trackers? They’re fine… for CeFi. But DeFi’s a whole different beast.

Here’s what makes it tricky:

- Multi-Chain Chaos – One day you’re on Ethereum, then it’s Polygon, then Solana. Not every tracker supports everything.

- LP Tokens and Staked Assets – Your tokens aren’t always sitting idle. They’re wrapped, staked, or buried in a yield farm contract somewhere.

- Impermanent Loss – It’s sneaky. You think you’re earning, but in reality, you might be better off just holding.

- Token Volatility – Some of these tokens can go full rollercoaster in 24 hours.

- Manual Tracking Sucks – Unless you love Excel sheets and sleepless nights.

It might seem messy, but there are tools for this.

Tracking Tools

You don’t have to do this by hand. There are actually some solid tools out there that can help, though none of them are perfect (and that’s okay).

1. Zerion

Super clean interface. Let’s you connect your wallet and see your positions across multiple chains. It shows you balances, historical performance, and even some staked assets.

Pros:

- Great UI/UX

- Decent multi-chain support

- Mobile app is solid

Cons:

- Might miss some DeFi positions on newer chains

- Not always up to date with obscure protocols

2. DeBank

Think of it like the Swiss Army knife of DeFi dashboards. It digs into your wallet and shows pretty much everything from tokens to LPs to borrowed/lent assets.

Pros:

- Comprehensive

- Good DeFi protocol coverage

- Free to use

Cons:

- UI can feel a bit overwhelming

- Data sometimes lags

3. Rotki

Privacy-focused and fully local. If you’re paranoid about sharing wallet data, this one’s for you. You download it, run it locally, and it tracks your crypto (not just DeFi) in a secure, non-cloudy way.

Pros:

- Privacy-focused

- Local-first software

- Great for tax reporting too

Cons:

- Manual setup required

- Less automated than cloud-based tools

4. Zapper

Zapper used to be the go-to. It’s still solid for basic DeFi tracking, especially if you’re big on yield farming or LPing. It auto-detects a lot of positions.

Pros:

- Clean dashboard

- NFT + DeFi tracking

- Good chain support

Cons:

- Has gotten a bit quiet lately in terms of updates

- Some users report issues with wallet syncing

5. APY.Vision (for LP nerds)

This one’s niche, but really handy if you provide liquidity and want to see how it’s actually performing, including impermanent loss.

Pros:

- Laser-focused on LP positions

- Shows actual vs. projected earnings

- Useful for AMM yield farmers

Cons:

- Less useful if you’re not doing LP stuff

- UI could be smoother

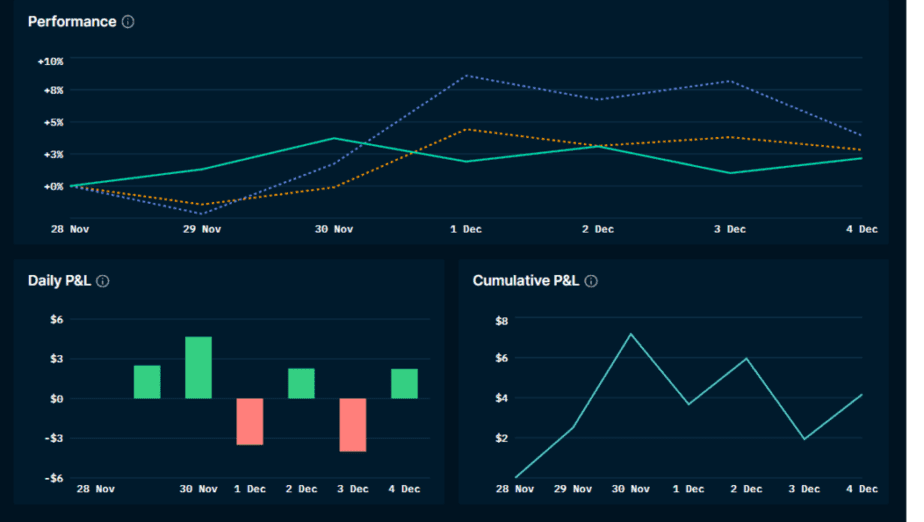

Tips for Using These Tools

Okay, now that you’ve got the tools, here’s how to actually make them work for you:

- Pick one or two – Don’t overcomplicate it. Most of them do the same basic thing. Pick the one that feels right and stick with it.

- Track performance over time – Don’t just look at today’s snapshot. See how your portfolio is moving week to week.

- Tag your positions – Some tools let you label stuff. “Long-term hold,” “degenerate farm,” “experiment.” This helps you know why you bought it in the first place.

- Set reminders – Seriously. Calendar reminders to check in weekly or bi-weekly. DeFi moves fast, and forgetting positions = risk.

- Watch gas costs – Especially when moving between protocols. You might be ‘earning’ 12% APY while spending 20% on gas.

What About Taxes?

Yes, taxes are a thing! If you’re in a country that taxes crypto (hint: most do), you’ll want to keep records. Some tools like Koinly, TokenTax, or even Rotki can help with that. Just don’t wait until April and realize you’ve got 500 transactions to reconcile.

Pro tip? Start logging your moves now, not later.

Conclusion

Here’s the deal: you’re not gonna catch every single detail. And that’s okay. DeFi’s still early, tools are still evolving, and honestly? Half the fun is figuring it out as you go.

But tracking something is way better than tracking nothing. Otherwise, you’re just guessing, and in DeFi, that’s a fast way to lose money.

Even if it’s just checking your dashboard once a week, labeling your plays, and keeping notes in Notion or a sticky note on your desktop, do it. You will be glad about it in future.

English

English