Risks of Smart Contracts in DeFi

DeFi (Decentralized Finance) sounds amazing on paper. You can lend, borrow, trade, and earn interest all without a bank in the middle. It’s like the wild west of finance, powered by code. And at the heart of it all? Smart contracts. These little lines of code promise to handle everything automatically, trustlessly, and securely. Sounds perfect, right? Well… not exactly. Here’s the thing: smart contracts are powerful, but they’re not invincible. And if you’re diving into DeFi, understanding the risks is more than just a ‘good idea’ – it’s survival.

1. Code Isn’t Law…Even If It Says So

A smart contract is basically a program that executes rules automatically when certain conditions are met. That’s great, because it removes human error – or so we think. But here’s the catch: smart contracts are only as good as the code behind them. And code is written by humans.

Humans make mistakes. Bugs happen. And when a bug exists in a smart contract, it can get exploited. There have been countless stories of millions of dollars getting drained from DeFi platforms just because of a tiny coding oversight. Sometimes it’s a missing check, sometimes it’s an untested edge case, but the result is the same: your crypto can vanish faster than you can say ‘rug pull’.

2. Rug Pulls and Exit Scams

Let’s talk about rug pulls. This isn’t really a ‘smart contract flaw’ in itself – but smart contracts make them easier. Some developers deploy a DeFi project, get you to deposit your funds, and then… poof. They drain the liquidity and disappear.

Smart contracts can lock your money in ways that you can’t reverse. And unlike a bank, there’s no FDIC insurance here. You can’t call up a customer service rep. You can’t ‘freeze’ a transaction. Once it’s gone, it’s gone. So, always check the team behind a project, the code audits, and yes, trust your gut. If it looks too good to be true, it probably is.

3. Code Vulnerabilities Are Real

Even legitimate projects with audits aren’t totally safe. Let me explain. Smart contracts often interact with each other – like a chain of dominos. One contract calls another, which calls another. If one domino is weak, the whole structure can collapse.

There are also common exploits that hackers love:

- Reentrancy attacks – basically tricking a contract into sending funds multiple times before it updates its balance.

- Integer overflow/underflow – math errors that let hackers create money out of thin air.

- Flash loan attacks – borrowing huge sums instantly to manipulate prices and drain pools.

Yeah, it’s technical. But the takeaway is simple: smart contracts are not ‘magic’. They can be bent, broken, and abused.

4. Oracles Can Be a Weak Spot

Smart contracts often need external data to work – like price feeds for tokens. That’s where oracles come in. Oracles are supposed to provide accurate, real-time info. But if an oracle is compromised or faulty, the smart contract can make wrong decisions.

Imagine a DeFi lending protocol thinking ETH is worth $5,000 when it’s actually $500. Suddenly, collateral gets liquidated unfairly, loans default, and chaos ensues. It’s rare, but it happens. And in crypto, rare can still mean millions lost.

5. Upgradability and Centralization Risks

Here’s a weird one: some smart contracts can be upgraded. Sounds good, right? The developers can fix bugs. But it also means they can change rules mid-game. Suddenly, your ‘decentralized’ contract has a bit of centralization baked in. And centralization = risk.

If the devs turn rogue, or get hacked themselves, your funds could be at risk. So, pay attention to whether a project’s contract is upgradeable and who controls those upgrades.

6. Economic Design Flaws

Even if the code is perfect, the economic model can fail. DeFi is full of experiments with tokenomics, staking rewards, and incentives. Sometimes, these designs are flawed, and users or hackers exploit them.

Remember that meme coin craze? Many protocols offered absurd APYs to attract liquidity. It worked… until it didn’t. People lost money, and contracts got drained – not because the code was bad, but because the system itself was unstable.

So yeah, ‘perfect code’ doesn’t automatically mean ‘safe money’.

7. Human Error Isn’t Just Coding Mistakes

It’s easy to forget that interacting with smart contracts isn’t always simple. Mistyping a wallet address, sending funds to the wrong chain, or approving unlimited access to your tokens – these are all mistakes people make daily.

And unlike traditional finance, there’s no one to reverse it. Mistakes get expensive. A single wrong click, and you could be looking at an empty wallet.

8. Regulatory Uncertainty

Here’s something people often overlook: regulations. DeFi exists in a grey zone. Governments are catching up. One day, a protocol could be perfectly legal, the next it’s deemed illegal, frozen, or sanctioned.

Your smart contract might be flawless, your code audited, but legal action could lock or seize funds in certain jurisdictions. Not exactly the ‘decentralized freedom’ we signed up for?

What Can You Do?

DeFi is exciting, and smart contracts open up new possibilities. But you have to be cautious. Here’s a quick checklist:

- Check for audits. They’re not foolproof, but they help.

- Understand the contract. At least enough to know what it’s doing with your funds.

- Don’t chase insane yields. If it sounds too good to be true, it probably is.

- Don’t throw all your crypto into one protocol.

- Follow the community. Often, if something smells off, the community catches it first.

And remember: DeFi isn’t your savings account. It’s experimental, risky, and yes, fun. But you need to treat it like a science experiment – carefully, cautiously, and never with money you can’t afford to lose.

The Bottom Line

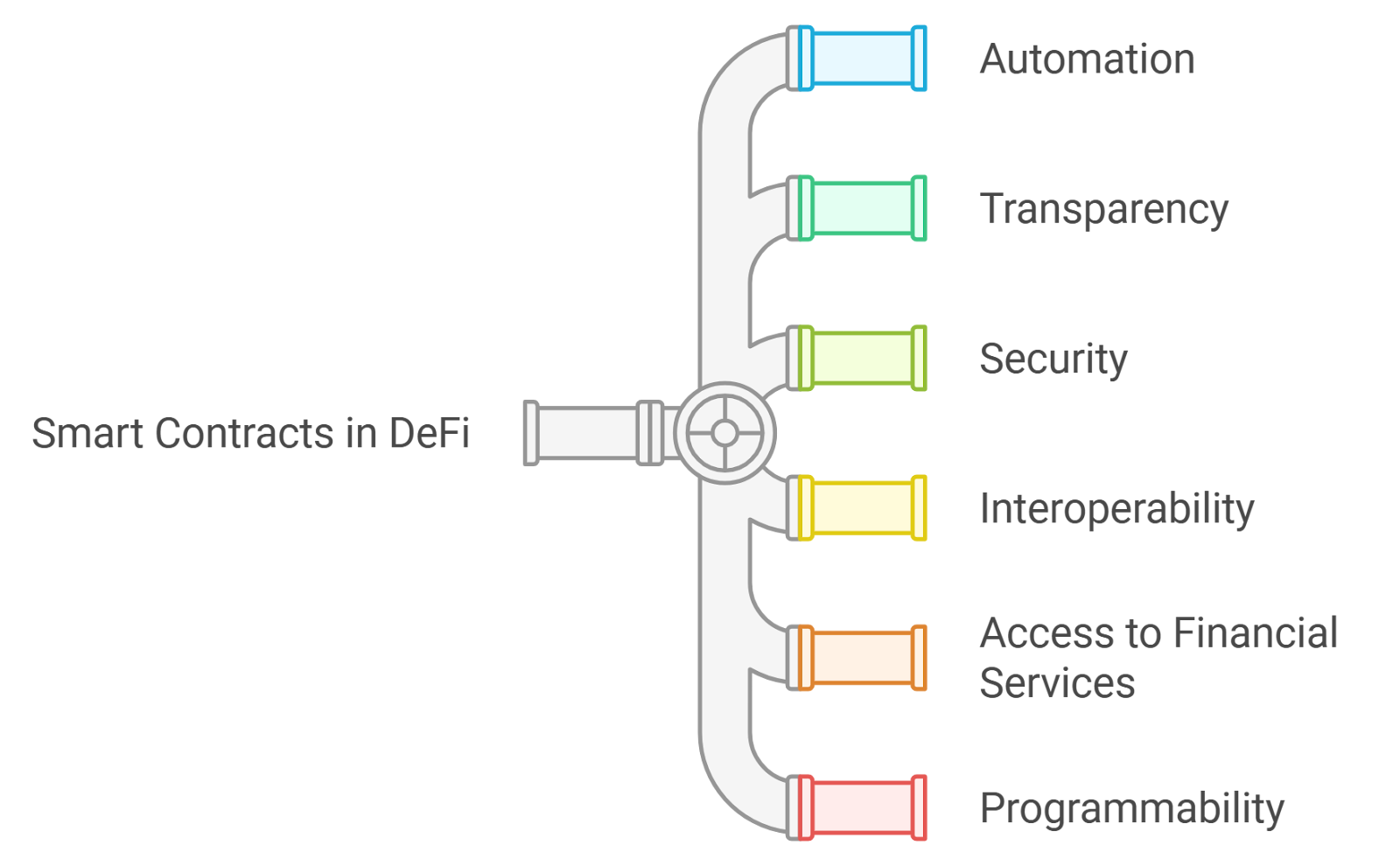

Smart contracts are brilliant, no doubt. They remove intermediaries, automate processes, and create entirely new ways to interact with money. But they’re not flawless. Code bugs, economic vulnerabilities, oracle failures, and human error all pose real risks.

Here’s the thing: DeFi isn’t about blindly trusting code. It’s about understanding it enough to make informed decisions. Be curious. Ask questions. Don’t be afraid to sit on the sidelines sometimes. Sometimes, the smartest move in crypto is patience.

At the end of the day, the promise of DeFi is huge – but only if you respect the risks that come with it.

English

English