What Is Impermanent Loss in Liquidity Pools?

DeFi can feel like a jungle sometimes. There’s yield farming, staking, farming LP tokens… and then there’s this thing called impermanent loss. If you’re just getting into liquidity pools, it can sound a little scary. But don’t worry – we’ll break it down in a way that actually makes sense.

So, what is impermanent loss anyway? In the simplest terms, it’s the difference between holding your crypto in a liquidity pool versus just keeping it in your wallet. That sounds weird, right? How could adding your tokens to a pool end up being ‘worse’ than just holding them? Let’s dig deeper.

Liquidity Pools 101

Before we get into impermanent loss, we need to talk about liquidity pools. These are basically pools of two (or more) crypto assets that traders can swap between. Think of it like a digital vending machine: if someone wants ETH for USDC, the pool facilitates the trade. In return for providing liquidity, you earn fees – usually a small percentage of each trade.

Here’s the kicker: you don’t just hand over your coins. You lock them in a smart contract. And this is where impermanent loss can sneak in.

How Impermanent Loss Happens?

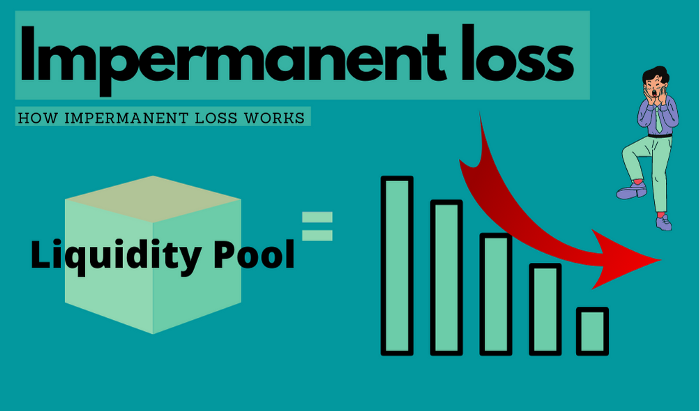

Impermanent loss happens because the price of the tokens you put in a pool changes relative to each other. Let’s use an example:

Imagine you add 1 ETH (worth $2,000) and 2,000 USDC to a pool. Total value: $4,000. Sounds simple so far. Now, let’s say ETH spikes to $3,000. If you had just held your ETH and USDC in your wallet, your total would now be $5,000.

But in the pool, the smart contract automatically rebalances your holdings to keep the pool balanced. After rebalancing, you might have 0.82 ETH and $2,460 USDC – totaling $4,920.

If you actually lost $80 compared to just holding, that’s an impermanent loss.

It’s ‘impermanent’ because the loss isn’t final – if the token prices go back to what they were when you added them, the loss disappears. But if you withdraw when prices have changed, it becomes permanent.

Why It’s Not Always a Deal-Breaker?

Here’s the thing: impermanent loss can sound scary, but it’s not always a huge problem. Why? Because trading fees and rewards often offset it.

Let’s go back to our ETH/USDC pool example. Each trade in the pool generates a fee – say 0.3% per swap. Over time, these fees can cover or even exceed the impermanent loss, especially if the pool is actively used.

Some pools also offer extra incentives. Many DeFi projects give out LP rewards, sometimes in their native tokens. Add it all up, and you could come out ahead – even if impermanent loss technically exists.

Things to Keep in Mind

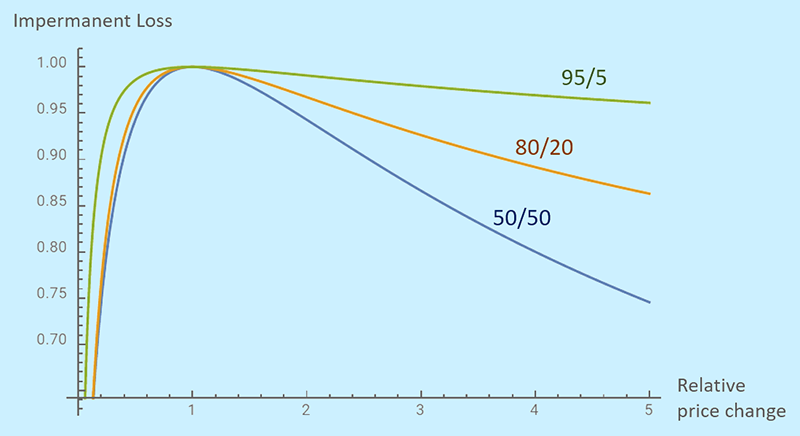

- More volatility = more impermanent loss.

If your pool has a highly volatile asset like ETH or BTC paired with a stablecoin, impermanent loss can hit harder. - Stablecoin pairs = less impermanent loss.

Pools like USDC/USDT barely fluctuate in price, so the loss is minimal. - Timing matters.

The longer you stay in a pool, the more fees you earn. But if token prices swing wildly, you could see bigger impermanent losses. - Exit strategy.

Always consider when you’ll withdraw. Leaving during a big price swing can lock in your loss permanently.

A Little Analogy

Think of it like a see-saw. You’re on one side with your tokens, and the market is on the other. If the market swings a lot, your side dips – impermanent loss. But if you hang in there, the see-saw might come back to balance – or fees could give you a boost to the top.

How to Minimize Impermanent Loss?

If you’re convinced it’s a real thing, how do you fight it?

- Choose stable pairs

Pools with two stablecoins or tokens that usually move together can drastically reduce losses. - Diversify

Don’t put all your crypto in one pool. Spread it across different pairs and protocols. - Watch the market

If you see a massive price spike, consider withdrawing temporarily. But this is tricky – you could miss out on fees. - Use impermanent loss calculators

There are online tools where you plug in token amounts and price changes to see potential loss. Handy for planning.

In Conclusion

Impermanent loss isn’t some evil trick DeFi is playing on you. It’s just how liquidity pools work – they rebalance automatically, and sometimes that means you earn less than if you’d just held your coins. But here’s the good part: if you pick the right pools, consider fees and rewards, and maybe even a little luck, you can still come out ahead.

Let’s be honest, no investment is free of risk. Impermanent loss is just one piece of the puzzle in the DeFi world. Learn it, plan for it, and you’ll navigate liquidity pools like a pro.

English

English