DeFi vs CeFi: Key Differences Explained

Crypto is full of jargon. You’ve probably heard people throw around terms like DeFi and CeFi as if they’re talking about everyday stuff. But let’s be real – if you’re new, it can feel like trying to learn a new language while juggling. So, let’s slow down and actually talk about what these two mean, why they matter, and how they’re different.

The Basics

DeFi stands for Decentralized Finance. CeFi stands for Centralized Finance.

Pretty straightforward, right? The names kind of give it away.

- DeFi = finance without middlemen. It’s built on blockchain, with smart contracts running the show instead of banks, brokers, or some guy in a suit approving your transaction.

- CeFi = the more ‘traditional’ approach, except that it’s crypto. You still go through a company or platform that acts as the middleman. Think Binance, Coinbase, Kraken – all CeFi players.

That’s the short version. But the juicy part is in the details.

The Control Question

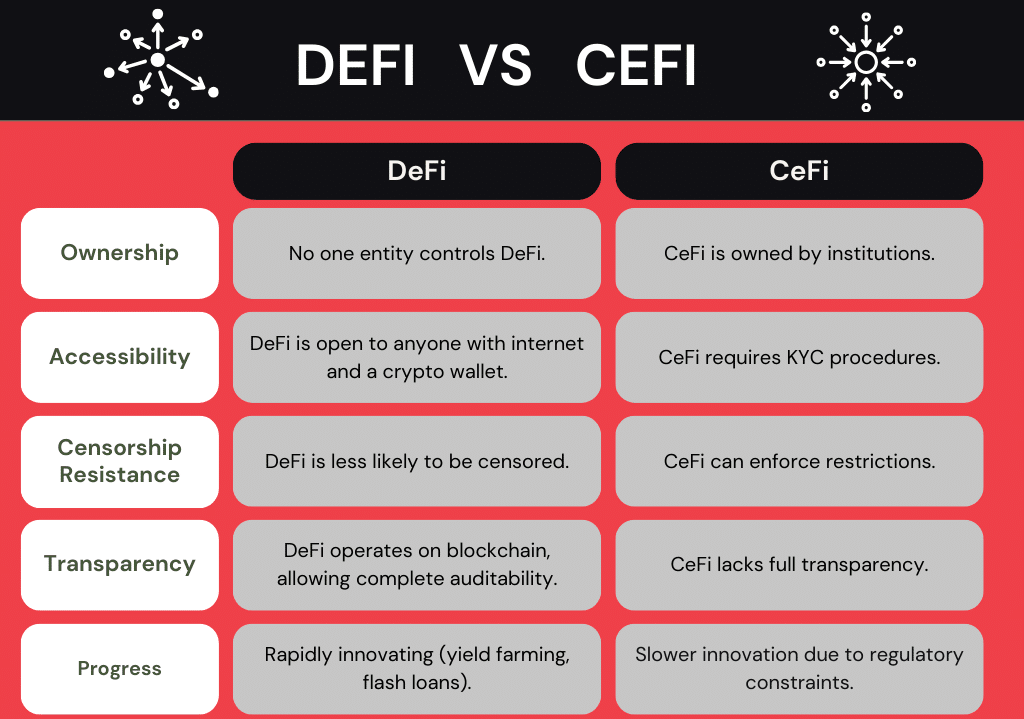

Here’s the biggest difference: Who controls your money?

In CeFi, you’re basically trusting someone else with your assets. When you deposit Bitcoin on an exchange, you don’t actually hold the keys to it. The company does. That means they have custody, and you’re hoping they’ll do the right thing. Most of the time, they do. Sometimes… not so much. Remember FTX? Yeah, that’s the danger.

With DeFi, it flips. You’re in charge. You keep your private keys. You connect your wallet (like MetaMask) to a protocol, and boom – you’re trading, lending, or staking directly. No one else is holding your coins. The trade-off? If you mess up, there’s no customer support hotline to save you. Lose your seed phrase? That’s it. Game over.

Trust vs Code

Another way to frame it: CeFi runs on trust in people. DeFi runs on trust in code.

With centralized platforms, you’re relying on the company’s reputation, regulations, audits, and hopefully their sense of responsibility. It’s like leaving your car with a valet – you trust they won’t take it for a joyride.

DeFi is different. It’s like an automatic parking system. No valet, no middleman. Just code. If the smart contract is written correctly, it’ll do exactly what it says. No bias, no human error. But here’s the catch – if the code has a bug, hackers can exploit it. And they do.

So, the question is: do you trust humans (who can lie, cheat, or collapse) or code (which can break if poorly written)?

Accessibility

This one’s big. CeFi usually requires KYC (Know Your Customer). You give them your passport, ID, or photo. It’s gatekept. If you live in a country that’s banned, you’re out of luck.

DeFi? Anyone with the internet can use it. Doesn’t matter if you’re in New York, Nigeria, or a cabin in the mountains with decent Wi-Fi. No paperwork. Just a wallet and some tokens. That’s why people call DeFi ‘borderless finance’. It doesn’t care who you are.

But, that freedom also makes it riskier. Scams, rug pulls, and copy-paste projects are everywhere. In CeFi, at least regulators try to keep things clean (emphasis on ‘try’).

User Experience

Let’s be honest, DeFi is not always beginner-friendly.

If you’re brand new to crypto, the process can feel like solving a puzzle. You download a wallet, copy seed phrases, pay gas fees, worry about networks…it’s intimidating. One wrong click and your tokens vanish into the void.

CeFi, on the other hand, is smoother. Sign up, deposit dollars, and buy Bitcoin with one click. Done. That’s why most newbies start with CeFi. It feels more like online banking, less like hacking into the Matrix.

Personally, I still remember the first time I used Uniswap (a DeFi exchange). I was terrified I’d mess something up. Double-checked the wallet address like ten times. That’s the DeFi learning curve – it forces you to be careful.

Yield and Opportunities

Here’s the deal: DeFi often offers higher returns. Lending, staking, yield farming – you’ll see crazy percentages sometimes. That’s because there’s no middleman taking a cut. You’re directly in the system.

CeFi platforms also offer staking and lending, but usually with lower returns. They need to make money too, so they keep a portion.

But high yield in DeFi comes with high risk. If it looks too good to be true, it probably is. If you see a DeFi project promising 10,000% APY, you don’t need to be a math genius to know that’s not sustainable.

Security

Neither side is perfect.

- CeFi can get hacked. And if the company collapses, your funds are gone.

- DeFi can also get hacked. Bugs, exploits, flash loan attacks – it’s like a hacker’s playground.

The difference is in who takes the hit. In CeFi, you’re trusting the company to protect your funds. In DeFi, you’re trusting yourself to not click on a phishing link.

Regulation

This is where things get messy. Governments can regulate CeFi exchanges. They can demand KYC, freeze accounts, or even shut down platforms.

DeFi is trickier to regulate. Who do you shut down? The code lives on the blockchain. Unless you can stop every node, it’s basically unstoppable. That’s why regulators are scratching their heads over DeFi – it doesn’t fit neatly into their boxes.

Which Is Better?

Honestly? It depends.

If you value convenience and safety nets, CeFi might be better. If you value freedom and control, DeFi is the way. Some people use both – CeFi for buying and cashing out, DeFi for experimenting and earning yield.

It’s like comparing Netflix and a massive open-source library. Netflix is easy, polished, and user-friendly. The library has everything, but you need to know what you’re doing.

In a Nutshell

The whole DeFi vs CeFi debate is less about ‘which is best’ and more about ‘what do you want?’ Do you want control, or do you want convenience? Do you trust humans or code?

Crypto’s still young. Both models have flaws, both have strengths. My guess? The future isn’t one or the other – it’s a messy mix of both. Hybrid models are already popping up. Centralized companies offering DeFi services, and DeFi protocols trying to be more user-friendly.

At the end of the day, whether you’re DeFi-maxi or CeFi-loyalist, just remember: this space moves fast. Stay curious, stay skeptical, and for the love of crypto – don’t invest more than you’re willing to lose.

English

English