What Makes a DeFi Protocol Safe?

DeFi sounds amazing on paper, right? Open finance, no banks, high yields, permissionless access, and more! It’s like someone threw a party where everyone’s invited, and there’s no bouncer at the door. But here’s the kicker – no bouncer also means anyone can sneak in and cause chaos. Hacks, rug pulls, dodgy code… we’ve seen it all.

So, the big question: what actually makes a DeFi protocol safe? Not completely risk-free (because honestly, nothing in crypto is), but at least trustworthy enough that you don’t wake up one morning to find your tokens gone. Let’s dig in.

1. The Code Matters

Here’s the deal. DeFi runs on smart contracts. If the code is flawed, everything else is pointless. Imagine building a house on sand. Doesn’t matter how fancy the walls are, the foundation will give in.

Now, most users don’t read Solidity code. And that’s fine. But there are signals. Has the protocol been audited by a legit security firm? Do they publish those audit reports publicly, or is it all vague hand-waving? Audits don’t guarantee perfection, but they at least catch the obvious stuff.

A little personal story: I once aped into a project that had ‘audit pending’ written on its site. Two weeks later, the devs vanished with the liquidity. Lesson learned: ‘audit pending’ usually means no audit.

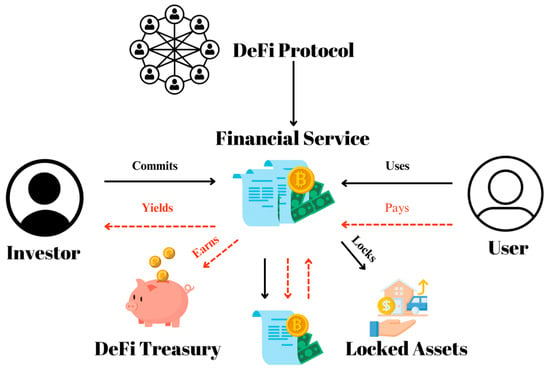

2. Decentralization Isn’t Just a Buzzword

You’ve probably seen projects brag about being ‘decentralized’. Sounds cool, but sometimes it’s just marketing. If one team or one wallet holds the keys to everything, is it really decentralized? Nope. It’s just another centralized service with a crypto label.

A safer DeFi protocol spreads out control. Think multi-sig wallets for treasury funds, or governance decisions voted on by the community. If one person can push a button and drain all funds, that’s not ‘safety’ – it’s a ticking time bomb.

3. Liquidity and Longevity

Here’s something people overlook: the older and bigger a protocol gets, the safer it tends to be. Not because old things are automatically safe, but because time is the ultimate stress test.

Uniswap, Aave, MakerDAO – these have been around, survived bear markets, hacks, and crazy volatility. Compare that to a shiny new farm promising 1000% APY. Which one do you trust more? Exactly.

It’s like dating: someone who’s been stable and reliable for years probably isn’t going to ghost you overnight. The new flashy fling? Fun, but risky.

4. Transparency = Trust

One thing I look for: does the team talk openly about risks? Or do they just hype up the returns? If all you hear is ‘guaranteed profit[ or ‘risk-free yield’, be aware that no such thing exists in DeFi.

Safer projects usually explain how they generate yields, where the risks lie, and what users should watch out for. Some even have Discord mods answering hard questions daily. That’s a good sign. Silence, on the other hand, is not golden – it’s suspicious.

5. Community and Reputation

This one’s underrated. A strong community acts like extra security. People notice weird things, raise red flags, and share info. If everyone in a Telegram chat is just spamming “wen moon??” and “buy now”, that’s not a community; that’s noise.

Real communities debate stuff. They challenge the devs. They hold them accountable. If a project has respected names backing it, or if people you trust in crypto recommend it, that adds weight. Of course, even reputations can be wrong (remember the influencers who hyped Squid Token?). Still, community is one of the best early warning systems we’ve got.

6. TVL and Activity

TVL stands for Total Value Locked – the amount of money sitting in the protocol. High TVL doesn’t equal safety, but it does show confidence. If billions are parked in a protocol, chances are someone did some due diligence.

But here’s a thought: sometimes, too much TVL attracts attackers. Like a giant vault, it becomes irresistible. So, it’s a balance. Medium-to-large TVL plus active daily users usually signals stability. A tiny protocol with $10k locked and no users? That’s one exploit away from being toast.

7. Insurance and Safety Nets

This is more recent, but worth mentioning. Some DeFi platforms integrate insurance options. If the protocol gets hacked, users can claim coverage. It’s not perfect (payouts can be slow, coverage limited), but it’s better than nothing.

Think of it like wearing a helmet while biking. It won’t stop the crash, but can save you from the worst.

8. The Red Flags

Okay, let’s be blunt. Some things scream danger. If you spot these, maybe just walk away:

- Anonymous team with zero track record

- ‘Too good to be true’ APYs

- No audit, no roadmap, no communication

- Liquidity locked for only a week (devs can pull the plug after)

- Overly complicated tokenomics no one can explain clearly

If you feel confused reading their docs, that’s often on purpose. Complexity hides fragility.

9. Personal Responsibility

At the end of the day, even the safest protocol has risks. Bridges get hacked, stablecoins depeg, devs make mistakes. If you put your entire savings into one protocol, you’re setting yourself up for heartbreak.

Rule of thumb to follow: never invest more than you’re okay losing. Spread your bets. Use cold wallets. Take profits. DeFi isn’t a set-and-forget savings account. It’s more like a high-speed racetrack – you need to keep your eyes open.

Wrapping Up

So, what makes a DeFi protocol safe? Not one thing. It’s a mix of solid code, transparency, decentralization, history, community trust, and your own caution.

Here’s the truth: safety in DeFi is relative. It’s never safe like a savings account in a regulated bank. It’s more like surfing. You can learn the waves, pick a decent board, and practice balance, but the ocean is still unpredictable.

If you ask me, the best approach is curiosity mixed with skepticism. Explore new projects, but ask tough questions. Follow the veterans, but think for yourself. And remember: if a protocol feels shady or confusing, your gut is probably onto something.

At the end of the day, DeFi’s freedom is both its beauty and its risk. No banks, no gatekeepers, no middlemen – just code, community, and courage. The question isn’t “Is this 100% safe?” It’s “Am I managing the risks in a way I can live with?” In DeFi, the bouncer isn’t at the door. You are.

English

English