The Role of Liquidity Providers in DeFi Protocols

If you’ve hung around DeFi Twitter or skimmed through a Uniswap tutorial, you’ve probably seen the term “liquidity provider” (LP for short). It sounds fancy, maybe even intimidating. But at its core, the idea is pretty straightforward: LPs are the folks who keep the DeFi machine running by putting their crypto into pools so other people can trade.

Sounds simple enough, right? Well… yes and no.

Let’s break it down.

Why Does Liquidity Even Matter?

Imagine walking into a small shop that only has one dusty soda bottle and a couple of candy bars. You try to buy chips, but there aren’t any. That’s what trading without liquidity feels like. There’s nothing to buy, and even if there is, the prices swing like a roller coaster because supply is so thin.

Markets—whether traditional stock exchanges or decentralized crypto protocols—need depth. That depth comes from liquidity. Without it, trading is clunky, expensive, and sometimes downright impossible.

That’s where liquidity providers step in.

What LPs Actually Do?

Here’s the deal: in decentralized exchanges (DEXs) like Uniswap, SushiSwap, or Curve, there isn’t a centralized middleman matching buyers and sellers like on Coinbase or Binance. Instead, you’ve got these pools of tokens—say ETH and USDC—sitting in smart contracts.

Traders interact with those pools. If someone wants to swap ETH for USDC, they do it against the pool, not another individual. But where do those tokens come from? That’s right—liquidity providers. They deposit their assets into the pool, and in return, they earn a cut of the trading fees.

Think of it like renting out your house on Airbnb. You’re not selling your house—you’re just letting people use it for a fee. LPs are renting out their tokens to the market.

The Rewards: Not Always as Juicy as They Look

Okay, so LPs earn fees. Sometimes, protocols even throw in extra token incentives (yield farming) to make it more attractive. When DeFi was booming in 2020, people were seeing double or triple-digit returns just by parking assets in pools.

But let’s be honest—those wild APYs aren’t always sustainable. Fees depend on trading volume, and token incentives get cut off eventually. Plus, markets cool down. If you go in thinking it’s free money, you’re in for a rude awakening.

The Big Scary Word: Impermanent Loss

If you’ve read about LPing before, you’ve probably seen the phrase “impermanent loss” (IL). Sounds complicated, but it’s really just a side effect of how pools balance themselves.

Here’s the short version: when you provide two tokens to a pool (like ETH and USDC), the smart contract automatically adjusts the ratio based on trades. If ETH’s price shoots up, the pool rebalances by selling some ETH for USDC.

End result? You might end up with less ETH than you started with. And if ETH keeps climbing, you’d have been better off just holding your coins outside the pool. That’s impermanent loss in a nutshell. It’s “impermanent” because if the price eventually goes back to where it started, the loss disappears. But let’s be real—markets don’t usually rewind themselves neatly.

So yeah, providing liquidity isn’t risk-free.

Why People Still Do It?

So if impermanent loss is a thing, why do people keep providing liquidity? A couple of reasons:

- Fees and incentives can offset IL. If trading volume is high, the fees earned might more than make up for losses.

- Exposure to multiple assets. LPing is like holding a blended basket instead of just one token.

- Supporting the ecosystem. Some hardcore DeFi users just like contributing. Without LPs, these exchanges don’t work.

Also, for some, it’s just exciting. Let’s not underestimate the thrill of experimenting with new protocols, chasing yields, or being early to a trend.

LPs Beyond Uniswap

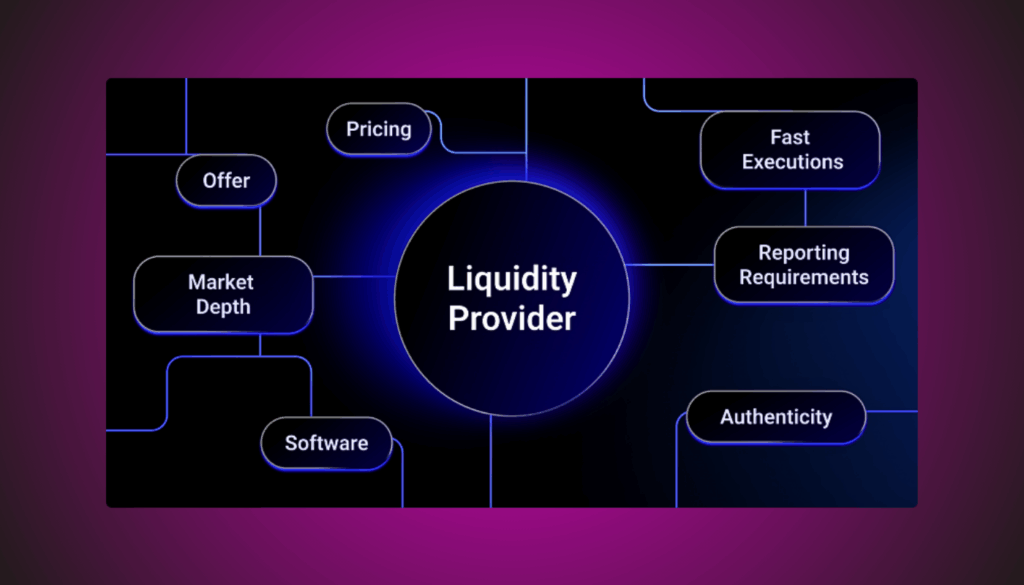

When most people think of liquidity providers, they picture AMMs (automated market makers) like Uniswap. But LPs play roles in other parts of DeFi too.

- Lending protocols. Supplying assets to Aave or Compound is also a form of providing liquidity. Borrowers take out loans from your deposits, and you earn interest.

- Stablecoin pools. Curve, for example, focuses on stablecoins and minimizes impermanent loss, making it attractive to LPs who prefer lower risk.

- Derivatives platforms. Even decentralized options or futures platforms need liquidity, whether it’s in collateral pools or order books.

Basically, if there’s a DeFi protocol, there’s usually a liquidity layer underneath it—and LPs are the ones filling that layer.

The Real Talk

Here’s something to keep in mind: providing liquidity is not passive income in the way most people think of it. Sure, your tokens are locked in a pool, and you’re technically “earning while you sleep.” But if you’re serious about it, you need to monitor things.

Token prices swing. Incentives change. Protocols get hacked (yeah, that’s another risk). So while LPing can be lucrative, it’s not set-and-forget. It’s more like tending a garden—you can’t just throw seeds in the ground and disappear.

My First Brush With LPing

I’ll be honest—my first time providing liquidity was kind of a mess. I tossed some ETH and DAI into a Uniswap pool without fully understanding impermanent loss. A month later, ETH had pumped hard, and my balance looked weird. On paper, I earned fees. But when I compared it to just holding ETH? I was down.

It stung. But it was also the fastest way to learn that LPing isn’t just about numbers flashing green. It’s strategy, timing, and sometimes just luck.

The Bigger Picture

Here’s the thing: liquidity providers aren’t just chasing yield. They’re literally the backbone of DeFi. Without them, all these protocols we rave about—swaps, lending, staking—would grind to a halt.

LPs create the conditions for decentralized markets to exist. They take on risks, yes, but they also keep the system alive.

And if DeFi keeps growing, the role of LPs will only get more important. Maybe new designs will solve impermanent loss. Maybe protocols will offer smarter incentives. Either way, LPs will still be at the center of it all.

Wrapping It Up

So, liquidity providers. They’re not some mysterious hidden class of whales. They’re just regular users—people like you and me—who put assets into pools so others can trade, borrow, and experiment in DeFi.

It’s not risk-free. There’s impermanent loss, smart contract exploits, and just plain old market volatility. But there are also rewards: fees, incentives, and the satisfaction of being part of something that’s reshaping finance.

If you’re thinking of trying it, start small. Play around with test amounts. Expect surprises. Because in DeFi, things rarely go exactly the way you think they will.

English

English